TradeHeader Blog

Read our articles about

Financial Standards and Technology

- Marc Gratacos

- February 10, 2026

ISDA Digital Regulatory Reporting (DRR) - Frequently Asked Questions (FAQ) for 2026

ISDA Digital Regulatory Reporting (DRR)is an industry framework from the International Swaps and Derivatives Association (ISDA) aimed at digitising, standardising and automating regulatory reporting for derivatives transactions.

Recent Articles

- Filter by:

- All

- Insights

- News

- Case Studies

- Events

- Marc Gratacos

- February 27, 2026

Marc Gratacos, Founder and Managing Partner of data standardisation expertsTradeHeader, explores how firms can move...

- TradeHeader

- February 12, 2026

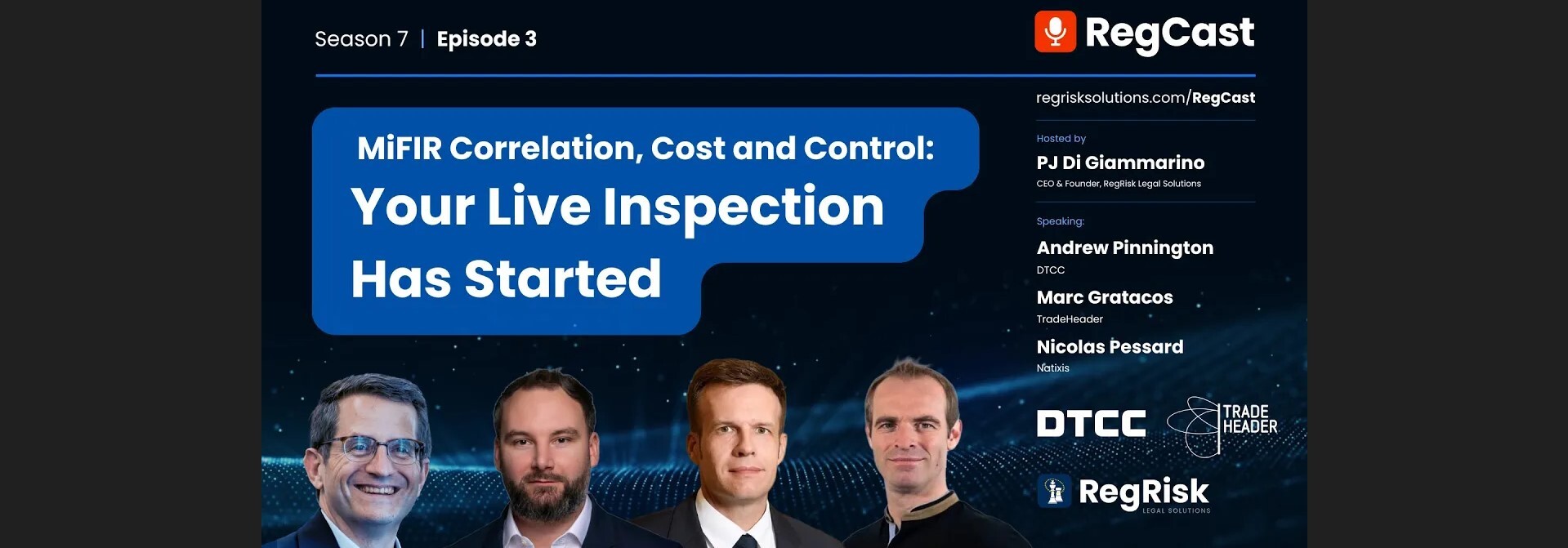

MiFIR reporting has entered live supervision — and data quality is now a supervisory judgement.

- Marc Gratacos

- February 10, 2026

ISDA Digital Regulatory Reporting (DRR) is an industry framework from the International Swaps and Derivatives...

- Marc Gratacos

- January 29, 2026

If you asked regulatory reporting professionals in 2025 what they required from 2026, the answer was uniform: stability.

- Marc Gratacos

- December 9, 2025

Legal opinions provide the certainty markets need, but reliance on static, complex PDFs is rapidly becoming a barrier...

- TradeHeader

- November 26, 2025

The milestone underscores TradeHeader’s commitment to advancing industry-wide data standardisation expertise, boosting...

Sign Up for Our Updates