The financial industry has long recognized the transformative potential of the ISO 20022 messaging standard. Designed to provide a universal language for financial communications, ISO 20022 promises enhanced data richness, improved interoperability, and greater standardization across global payment systems. Despite these benefits, the real-world adoption of ISO 20022 has encountered significant challenges, particularly regarding the lack of harmonization across different payment market infrastructures.

The ISO 20022 adoption challenge

Since the decision by the Swift community in 2018 to transition to ISO 20022 for cross-border payments and reporting, financial institutions and payment infrastructures worldwide have been gearing up to adopt the new standard. ISO 20022 is expected to be utilized in over 80% of high-value payment clearing and settlement by 2025, demonstrating its anticipated reach and impact. However, this widespread adoption has not been without its hurdles.

Fragmentation in ISO 20022 implementations

One of the most pressing issues is the fragmentation caused by varied implementations of ISO 20022 across different jurisdictions and payment systems. Although ISO 20022 aims to be a universal standard, its implementation often varies to meet local requirements and regulatory frameworks. This results in each Payment Market Infrastructure (PMI) adopting specific versions or subsets of the ISO 20022 data model. These adaptations are often encapsulated in 'Usage Guidelines' that restrict or tailor certain elements of the standard to better fit local needs.

While these tailored implementations can simplify processes within individual jurisdictions, they collectively lead to a fragmented landscape. Diverse message specifications and format constraints across different payment systems hinder seamless integration and interoperability. This fragmentation poses significant challenges for software vendors and financial institutions, who must navigate a maze of varied standards to achieve global interoperability.

Lack of harmonization: TARGET2 RTGS and HK CHATS

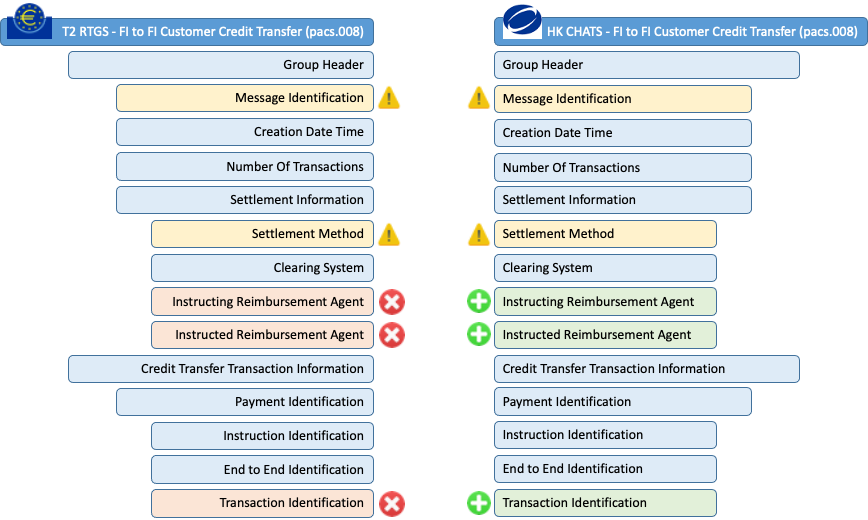

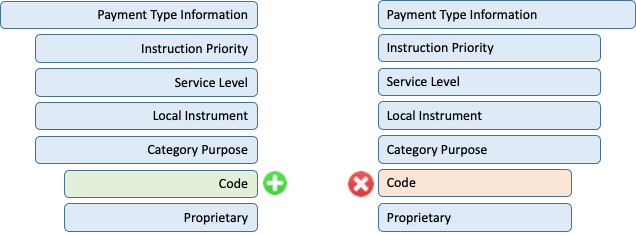

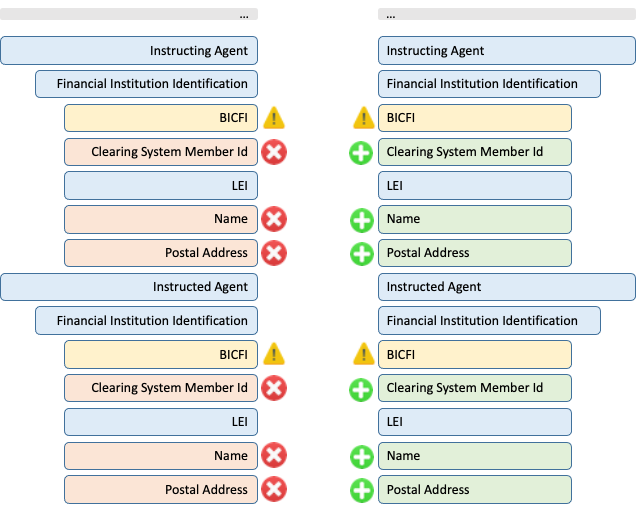

There are plenty of examples of the lack of harmonization between Payment Infrastructures, one of them can be seen in the differences between TARGET2 RTGS (Real-Time Gross Settlement) in the Eurozone and Hong Kong's Clearing House Automated Transfer System (HK CHATS). Both systems use the ISO 20022 standard, but their implementations of the pacs.008 message—used for customer credit transfers—differ significantly.

TARGET2 RTGS: This system has specific requirements and restrictions for the pacs.008 message format to comply with European Central Bank regulations. For instance, certain fields are forbidden in TARGET2 RTGS usage guidelines as opposed to other Market Infrastructures.

HK CHATS: Conversely, the HK CHATS system in Hong Kong follows its own set of rules and adaptations for the pacs.008 message. These guidelines are tailored to meet local regulatory requirements and the operational needs of the Hong Kong Monetary Authority (HKMA). As a result, the same message includes different mandatory fields, optional elements, and unique constraints compared to the TARGET2 RTGS implementation.

These differences mean that a software vendor or financial institution operating in both regions must develop and maintain separate message mappings and validation rules to comply with each system's specifications. This increases complexity, the risk of errors, and the cost of development and maintenance.

Challenges faced by the industry

The lack of harmonization in ISO 20022 implementations presents several challenges:

- Complex Integration: Software vendors and financial institutions must develop and maintain multiple versions of ISO 20022 message mappings to cater to different PMIs, increasing complexity and development costs.

- Interoperability Issues: Disparate implementations make it difficult to ensure smooth communication between different payment systems. This lack of interoperability can lead to delays, errors, and increased operational risk.

- Regulatory Compliance: Each jurisdiction’s specific requirements add layers of regulatory complexity. Financial institutions must ensure that their systems comply with varying local regulations, which can be time-consuming and costly.

- Resource Intensity: Constantly evolving ISO 20022 standards require regular updates and maintenance. The resource investment needed to keep up with these changes can strain financial institutions, particularly smaller entities with limited IT capabilities.

Addressing the gap

Addressing these challenges requires innovative solutions that can harmonize ISO 20022 messages and facilitate efficient communication across different payment systems. Effective solutions must provide a unified framework for message interpretation and translation, enabling consistency and interoperability. Additionally, these solutions should offer adaptive mapping and transformation tools to manage the evolving nature of ISO 20022 standards, thereby minimizing disruption and accelerating time to market.

Moreover, comprehensive compliance frameworks are essential to ensure adherence to regulatory standards and industry guidelines. By automatically validating messages against predefined rules and regulations, financial institutions can mitigate compliance risks and enhance data integrity.

Lastly, real-time monitoring and analytics capabilities can provide actionable insights into ISO 20022 messaging workflows. This allows for proactive management of message processing activities, performance metrics, and compliance status, facilitating informed decision-making and continuous optimization.

Conclusion

The lack of harmonization in ISO 20022 message specifications across different payment market infrastructures remains a significant challenge for the financial industry. However, by leveraging advanced solutions that unify, adapt, and comply with the varied implementations of ISO 20022, the industry can overcome these barriers. Such innovations will not only streamline the adoption process but also enhance the efficiency, reliability, and security of global payment systems. As the financial landscape continues to evolve, the drive towards harmonized ISO 20022 messaging will be crucial in achieving the promised benefits of this transformative standard.