The ISDA AGM is one of the most important conferences for derivative professionals. It usually takes place during spring and this year the conference took place in Tokyo, Japan. TradeHeader repeated as Silver sponsor for the event, showing our commitment to the industry and the projects ISDA is developing to standardize and automate derivatives processing. These include the Common Domain Model (CDM), Digital Regulatory Reporting (DRR), and FpML.

ISDA CDM/DRR Training Course

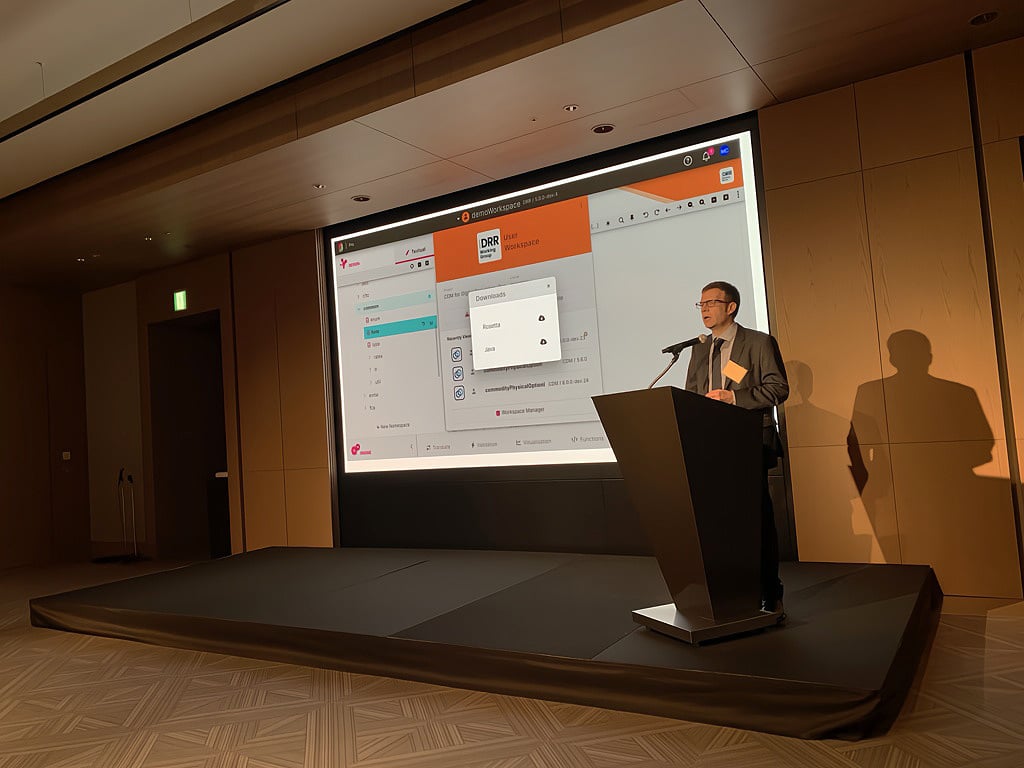

We arrived in Tokyo on Sunday afternoon before the week of the conference. On Monday, ISDA organized a CDM/DRR training course for Japanese financial institutions, including banks, asset managers, vendors, and regulators (JFSA). The training was half day and it was translated simultaneously into Japanese. We also prepared the materials (presentations, demo videos) well in advance in English so they could be translated into Japanese for the training. We delivered part of the training together with the ISDA Digital Solutions team and PwC Japan. We got very good questions from the audience and the training was very well received.

On Monday evening we went for dinner to Gopanchi. It is a touristy restaurant from which Quentin Tarantino got inspired for some of the battle scenes of Kill Bill. The place is very cool.

ISDA CDM-Digital Regulatory Reporting (DRR) Introductory Roundtable

On Tuesday there were a series of roundtable discussions before the official AGM actually started. ISDA organized a CDM-DRR Reporting Roundtable. Financial institutions and vendors participated in the roundtable. It was an interesting discussion with some key points:

- There are firms using DRR in production, using it as a core component of their reporting engines.

- Changes to regulations are not going to stop.

- ISDA is committed to keep adding new regulations and updates to DRR.

- Some inconsistencies between regulations will exist.

- The implementation of DRR is a strategic investment in order to take advantage of the mutualization and reusability between jurisdictions.

- DRR doesn’t replace firms’ internal controls/exception management system, reference data, and reconciliation.

- One of the main issues firms are facing is the mapping from their internal data to CDM. TradeHeader can definitely help with this.

- Vendors can provide value added services on top of DRR.

- DRR can be used as a benchmark against your own implementation, an “auto-certification” tool for regulatory reporting.

ISDA CDM Collateral Roundtable

Right after the DRR session, ISDA organized the CDM Collateral Roundtable. It was also very well attended and it was very interesting to see how firms and particularly collateral vendors are using CDM to standardize their APIs. They provide a CDM API to clients so that they can reduce the data translation cost to their internal data models from both sides. Firms are not yet using CDM natively for their collateral models but as a mechanism for interoperability.

AGM Sessions

Sessions at the AGM confirmed the push for technology in the derivatives market. In addition to the projects mentioned above, the ISDA MyLibrary, the new Notices Hub, ISDA SIMM,...there are many initiatives to digitize and automate processes.

Besides the regulatory updates, there are upcoming regulatory changes that will have an impact on the market globally, for example, the upcoming mandatory US treasury clearing mandate in the US. US treasury is an asset used globally in the financial markets and the fact that the US regulators are asking for mandatory clearing, increases the complexity and costs of its processing.

From a business perspective, another interesting topic discussed at the AGM was that there is a strong push to increase asset management activity in Japan. There were discussions around the drivers for increased business and how firms are preparing for that. In addition, it presents opportunities for vendors to support automation.

It was also very interesting to hear cybersecurity as one of the main risks firms are facing. It’s not only geopolitical risks but global cybersecurity challenges are increasing.

Improving the composition and transparency of the Credit Determinations Committee was also one of the main topics of the CDS session.

Another relevant discussion was around Verified Carbon Credits and how, as an industry, we can avoid greenwashing.

It was a very good AGM. Lots of relevant information, interactions with industry members and a clear focus on automation and how it can help the business. The evening events were also outstanding.